- March 1, 2024

- Posted by: FLORES

- Categories: Accounting, Business Strategy

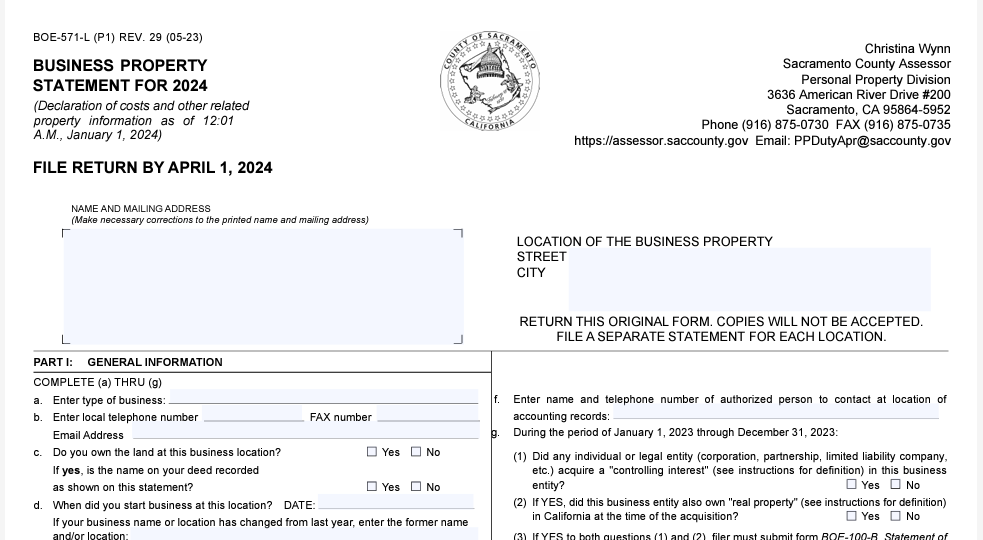

571-L Form Business Property Statement

possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the

Assessor’s Office by the date cited on the face of the form as required by law. Failure to file the statement during the time provided in

section 441 of the Revenue and Taxation Code will compel the Assessor to estimate the value of your property from other information in

the Assessor’s possession and add a penalty of 10 percent of the assessed value as required by section 463 of the Code.

If you own taxable personal property in any other county whose aggregate cost is $100,000 or more for any assessment year, you must

file a property statement with the Assessor of that county whether or not you are requested to do so. Any person not otherwise required

to file a statement shall do so upon request of the Assessor regardless of aggregate cost of property. The Assessor of the county will

supply you with a form upon request.

Except for the “DECLARATION BY ASSESSEE” section, you may furnish attachments in lieu of entering the

information on this property statement. However, such attachments must contain all the information requested by the

statement and these instructions. The attachments must be in a format acceptable to the Assessor, and the property statement must

contain appropriate references to the attachments and must be properly signed. In all instances, you must return the original

BOE-571-L.

For more information on the purpose of this form, who must file it, and when to file, read the full article here – 571Linst.pdf (sdarcc.gov)

If you have any questions or need help understanding how this may affect your business, give FLORES a call. Our HR department would be happy to assist you in any way we can.

Contact us at 619-588-2411