- January 12, 2023

- Posted by: FLORES

- Categories: Accounting, Business Strategy

Minimum Wage Increase Reminder

Due to the enactment of Senate Bill (SB) 3, the California minimum wage increased to $15.50 per hour, effective January 1, 2023, for all employers, regardless of size.

Employers always must pay the local minimum wage in the employer’s place of business if it is higher than the state minimum wage. And employers with exempt employees should evaluate their workers’ salaries because exempt employees in California generally must earn a minimum monthly salary of no less than two times the state minimum wage for full-time employment.

Ensure your payroll team is prepared to process the increases and your back end support is aligned with ensuring your staff is properly paid with proper wage earnings as of the first of the new year.

Be prepared for wage compression and how you will handle such conversations and decisions for your business. Minimum wage increases most often lead to wage compression issues, meaning if a person is currently 5% above minimum wage rates, they may expect to be 5% above in the coming year as well which could me more raises for employees already above the minimum wage threshold. In what is already a difficult labor market your plan must be rock solid in addressing these types of issues so as to set clear communication and not cause operational disruption.

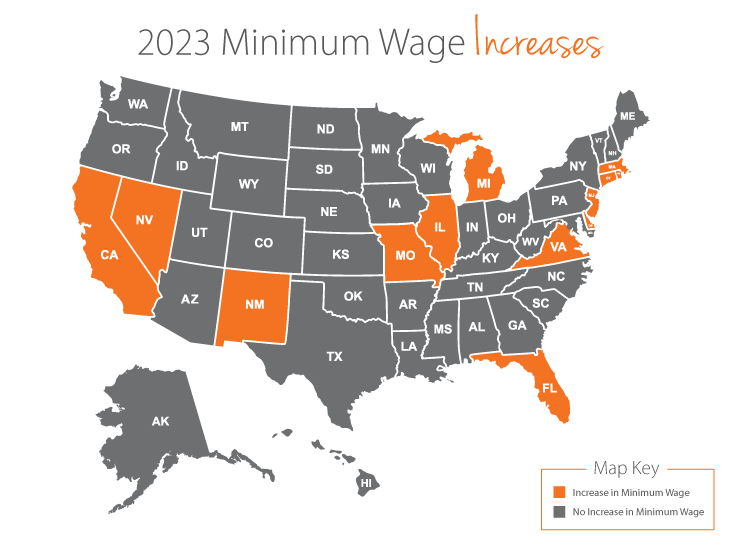

Here is a complete listing of minimum wages for the United States in 2023. These tables are subject to change pending legislation and local ordinances.

| County or City | 2022 Minimum Wage | 2023 Minimum Wage | 2022 Minimum Wage for Small Businesses | 2023 Minimum Wage for Small Businesses |

| Alameda | $15.75 | 15.75 + CPI (not to exceed 5%) | – | – |

| Belmont | $16.20 | 16.20 + CPI | – | – |

| Berkeley | $16.99 | 16.99 + CPI | – | – |

| Cupertino | $16.40 | 16.40 + CPI | – | – |

| Daly City | $15.00 | $16.07 (effective 1/1/23) | – | – |

| East Palo Alto | $15.60 | $15.60 + CPI | ||

| El Cerrito | $16.37 | $16.37 + CPI | – | – |

| Emeryville | $17.48 | $17.48 + CPI | – | – |

| Foster City | $15.75 | $16.50 (effective 1/1/23) | ||

| Fremont | $16.00 for all employers | $16.00 + CPI for all employers | – | – |

| Half Moon Bay | $15.56 | $15.56 + CPI (up to 3.5% per year) | – | – |

| Hayward** | $15.56 | $15.56 + CPI | $14.52 | $15.00 |

| Los Altos | $16.40 | $16.40 + CPI | – | – |

| Los Angeles | $16.04 ($18.86 per hour for employees at large hotels ) | $16.04 + CPI ($18.86 per hour for employees at large hotels) | – | – |

| Los Angeles County | $15.96 | $15.96 + CPI | – | – |

| Malibu | $15.96 | $15.96 + CPI | – | – |

| Menlo Park | $15.75 | $15.75 + CPI capped at 3% | – | – |

| Milpitas | $16.40 | $16.40 + CPI | – | – |

| Mountain View | $17.10 | $17.10 + CPI | – | – |

| Novato** | $15.53 | $15.53 + CPI (for businesses with 26-99 employees) | $15.00 | – |

| $15.77 for businesses with 100+ employees | $15.77 + CPI (for businesses with 100+ employees) | |||

| Oakland | $15.06 | $15.50 (new State-wide minimum wage effective 1/1/23) | – | – |

| Palo Alto | $16.45 | $16.45 + CPI | – | – |

| Pasadena | $16.11 | $16.11 + CPI | $14.00 | $15.00 |

| Petaluma | $15.85 | $17.06 (effective 1/1/23) | – | – |

| Redwood City | $16.20 | $16.20 + CPI | – | – |

| Richmond | $15.54 | $15.54 + CPI | – | – |

| San Carlos | $15.77 | $15.77 + CPI capped at 3.5% | – | – |

| San Diego | $15.00 | $16.30 (effective 1/1/23) | – | – |

| San Francisco | $16.99 (Government supported employees – $15.03) | $16.99 (effective 7/1/22 – 6/30/23) | – | – |

| San Jose | $16.20 | $16.20 + CPI | – | – |

| San Leandro | $15.00 | $15.50 (new State-wide minimum wage effective 1/1/23) | – | – |

| San Mateo | $16.20 | $16.20 + CPI | – | – |

| Santa Clara | $16.40 | $16.40 + CPI | – | – |

| Santa Monica | 15 $15.96 | $15.96 + CPI | – | – |

| Santa Rosa | $15.85 | $17.06 (effective 1/1/23) | – | – |

| Sonoma | $16.00 | $17.00 + CPI for large employers; $16.00 + CPI for businesses with less than 25 employees (effective 1/1/23) | $15.00 | 16.00 (effective 1/1/23) |

| South San Francisco | $15.80 | $15.80 + CPI | – | – |

| Sunnyvale | $17.10 | $17.10 + CPI | – | – |

| West Hollywood | $16.50 for large employers. $16.00 for employers with fewer than 50 employees | $18.86 for large employers (effective 7/1/23) | $15.00 increasing to $16.00 | $17.00 increasing to $18.86 (effective 7/1/23) |

| $18.35 for hotel employees | $18.86 for businesses with less than 50 employees (effective 7/1/23) | |||

| $18.86 for hotel employees (effective 7/1/23) |

If you need help preparing for how these wage increases will affect your business our FLORES team can help. We are here to strategically support your operation and help our clients achieve success.

Contact us at 619-588-2411